Gross income calculator yearly

Youll land on a page with an online salary tax calculator. Calculating gross income for businesses is a bit different.

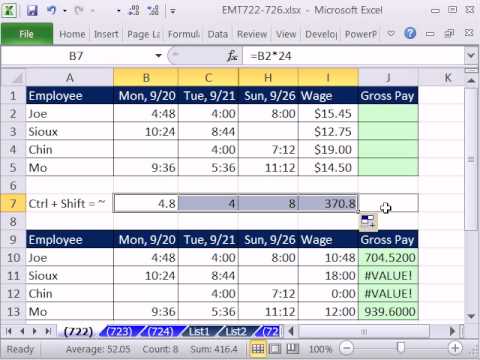

Hourly Pay Calculator Sale Online 56 Off Ilikepinga Com

Youll only start paying tax once your earnings go above that sum.

. On your 1040 your business income and loss is calculated on Schedule C. Gross income Gross revenue - Cost of. Click any one of the displayed options of results.

The taxes and deductions are calculated according to the income. If you want to learn more about taxes and other levies paid in Poland check out our other calculators. Revenue by product or service.

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. You can learn more about how the California income tax compares to other states income taxes by visiting our map of income taxes by state. Taxpayers and households use the IRS form 1040 to calculate and file their yearly taxes.

AGI is calculated when individual US. Gross income per month Hourly pay x Hours per week x 52 12. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions.

Gross income is money before taxationYou can read more about it in the gross to net calculator. AGI has several uses. You can enter the Gross Income paid to an employee as per the different pays and period stated above.

Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE. The top ten channels managed to gross at least 25 million each in pre-tax earnings in the year ending June 1 2015. 2022 tax refund calculator with Federal tax medicare and social security tax allowances.

In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work. SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes. Polish salary 1 yearly - see what is happening with your salary month by month the calculator supports both an employment contract a specific task contract and a job order contract Polish earnings 2 taxno tax - simple conversion between gross and net earnings.

Thank you so much. Gross Paycheck --Taxes-- --Details. If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505.

You can calculate your net business income by subtracting your qualified business expenses including materials tools and labor costs from your gross earnings. NIS Non-taxable allowance Chargeable Income and the taxes deducted as per the 28 and 40 tax bands are generated automatically. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

This was exactly what I needed. Use our simple NOI calculator above or do your own NOI calculation using the following formula. The amount of Care Insurance will be reduced for employees having a child.

The amount of Care Insurance will be reduced for employees having a child. AGI calculator or adjusted gross income calculator is a tool to estimate your adjusted gross income AGI which helps you determine your taxable income and tax bracket. Definition of take-home pay.

32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses. Gross income for businesses is their revenue minus their COGS so the formula is as follows. Swede Felix Kjellberg better known as PewDiePie managed to gross 12 million in that financial year - not too bad an income for somebody who spends his days playing video games.

Income tax calculator 2022-23 Pakistan or Salary Tax Calculator 2022 and youll come across many search-relevant results. An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimesThe calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax liability of an individual. The result in the fourth field will be your gross annual income.

Once youve calculated your Gross Operating Income and Operating Costs you will be able to subtract your running costs ie. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. Lets get started.

Urban High School Student. First thing to consider is the fact that youll have a personal allowance of 12570 a yearThis means that for the first 12570 from your yearly gross salary you wont pay any tax. And if you live in a state with an income tax but you work in Texas youll be sitting pretty compared to your neighbors who work in a state.

Assume that Sally earns 2500 per hour at her job. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator. Lets work through how to calculate the yearly figure by using a simple example.

The Year to Date calculations eg. How to use our Tax Calculator. The calculator also determines the employers contributions which comprise pension insurance unemployment insurance health insurance and contributions for additional care provisions.

Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example. Yearly Federal Tax Calculator 202223. For a gross income example lets assume that after you go over your accounts you find your gross receipts for the year equal 20000.

Gross Operating Income. Instead of considering the weeks or months in a year they must look at their COGS. Remember to add back in any 401k or other savings deductions to the paycheck you see since these are really part of what you are taking home you just happen to be saving it automatically.

Gross Yearly Earned Income Tax Credit. Gross income minus all taxes. 1 Do not include yourself or your spouse.

Example of Annual Income Calculator. Either the monthly or yearly amount can be. The first four fields serve as a gross annual income calculator.

Comparison of Education Advancement Opportunities for Low-Income Rural vs. To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. Forbes Top 10 Earning YouTube Stars of 2021 were.

305 of the Gross Wage will be paid by the employee and by the employer together half by half. Your refunds total 1000 leaving you with 19000 in sales. You just converted your hourly wage to your yearly salary.

Sales Key Performance Indicators KPIs These sales metrics are important for measuring company-wide performance. Tips for using the Tax Form Calculator. It says that you have to add back any deductions to your take home pay.

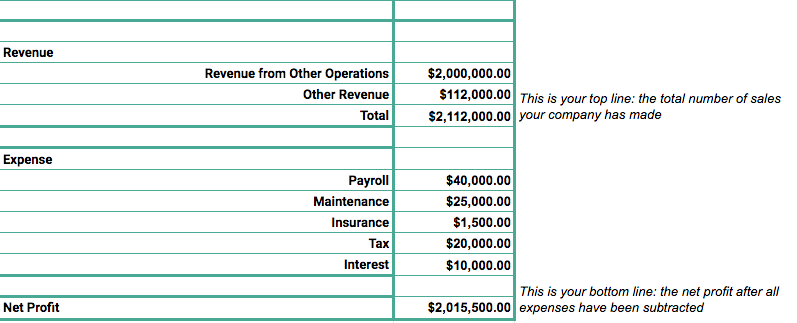

Enter your grossnet wage here. Operating Expenses from the yearly rental income earned ie. Total revenue refers to the total amount of income generated from all operational and sales activities across all products and services.

If you have a net gain from your business it counts as ordinary income. Math Behind the Salary Calculator. This refers to the income generated per product.

What is an Income Tax Calculator. Federal Income-- --State Income-- --. 305 of the Gross Wage will be paid by the employee and by the employer together half by half.

Your gross salary income in Pakistan includes your basic pay and other allowances.

Annual Income Calculator

How To Calculate Net Income Formula And Examples Bench Accounting

How To Calculate Income Tax In Excel

1 200 After Tax Us Breakdown August 2022 Incomeaftertax Com

Annual Income Calculator

How To Calculate Income Tax In Excel

Sales Revenue Formula Calculate Grow Total Revenue

Gross Pay Definition What It Is How To Calculate It Sage Advice Us

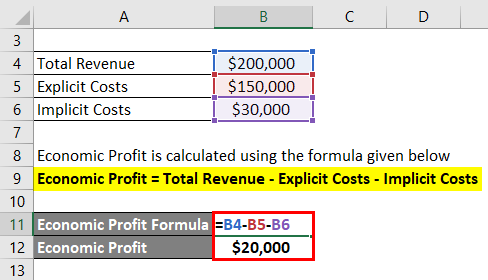

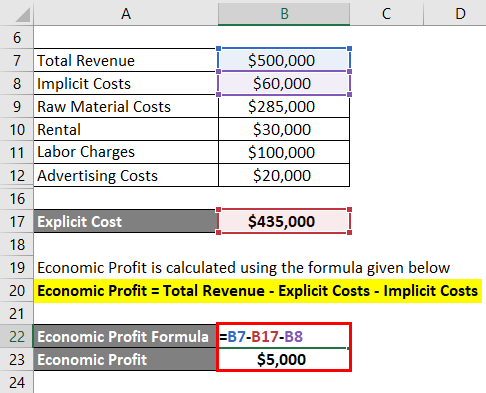

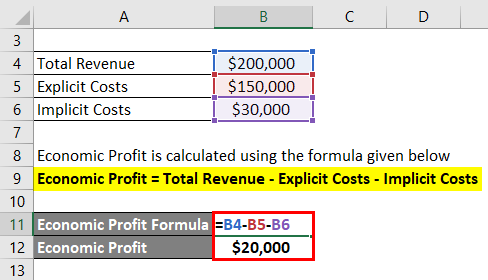

Economic Profit Formula Calculator Examples With Excel Template

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Usda Home Loan Qualification Calculator Freeandclear

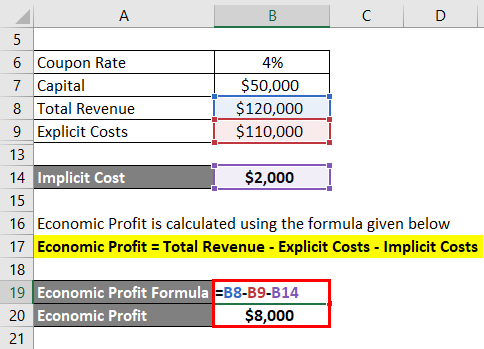

Economic Profit Formula Calculator Examples With Excel Template

Economic Profit Formula Calculator Examples With Excel Template

Coupon Rate Formula Calculator Excel Template

Hourly Pay Calculator Sale Online 56 Off Ilikepinga Com

How To Calculate Net Income Howstuffworks

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ